We’ll look at 10 last-minute tips to help with your Income Tax returns. It’s a busy time of year in the office. Training is on hold. Tea breaks are shorter, and lunches just about happen. The Tax Return deadline is looming. Accounts for review and finalise. A few weeks to go till the deadline hits.

Category Archives: Choosing an accountant

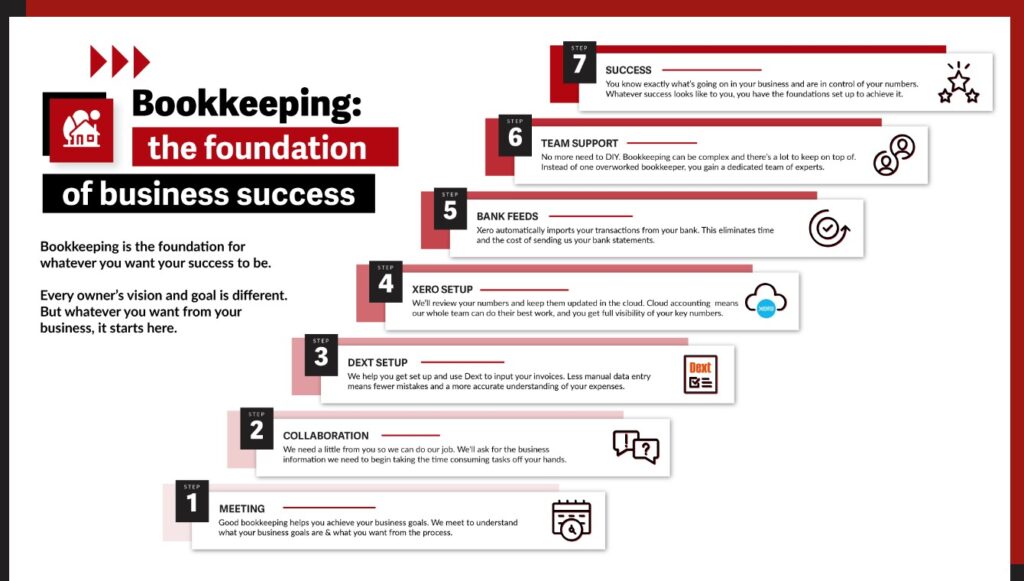

A catchy title. Bookkeeping – Outsource or Die is the title of a book. We were working with a business coach for accountants in the UK and the guest speaker Mark wrote it. He was a UK national living in the Philippines. He and his team provided outsourcing solutions to UK accountants. Successful and smart,

Let’s have a look at 5 Income Tax return Tips for 2022. We are now at peak Corporation Tax return filing time. On Monday the focus will switch to Income Tax returns for 2022. All with the view of keeping our clients tax compliant and Revenue happy. Revenue want the Tax return to know how

We’ll have a look at Company Taxes – The Basics, so please stick with me as it’s a hard sell. The best way to do this is by using an example to run through the basics. This will help you stay awake. Trust me on this one. Let’s delve into Introduction The Agenda The Meeting

Time of the year. More tax meetings with Company Directors than normal. Some are with clients and others are one-off consultations. A wide range of topics discussed. From electric cars to Income Protection, a lot of issues looked at. The question is always, what should I do? Let’s look at some of these to include

My friend John calls me a bean counter, knowing that I am part of an accountancy and tax business. The bean counter reference is an accusation. A not-so-subtle dig at the accountancy profession. He doesn’t hold accountants in high esteem and is brutally honest about it. I came across the Bean Counter Cafe on my

It’s decision time for many company directors across the country. Should I take a bonus? We will look at a few examples of what I am talking about. One of which is how your business can help with personal wealth. The focus will be on Bar Coad Ltd and the options for Tommy. Talking points

We will look at bookkeeping and how a partnership approach can make your life easier. Plus, it can improve the bottom line and put more cash in your pocket. Introducing you to Conor and Amy [their real names] we will touch on some of the things that helped them. And why they decided to use

Price increases and value. Is the price increase tolerable for your client because they see value in your service? This question punched us in the face recently. Michael, our client, was about to leave as he got a cheaper price. He said to me “as my financial advisor what would you advise me to do?”

Bookkeeping – Nail the foundations. Why should I do that? What’s in it for me? What even are the foundations? Sure, I’ll be grand. But will you? This isn’t a lecture about you should do this and if you don’t then you are in big trouble. It is more to discuss what the basics are