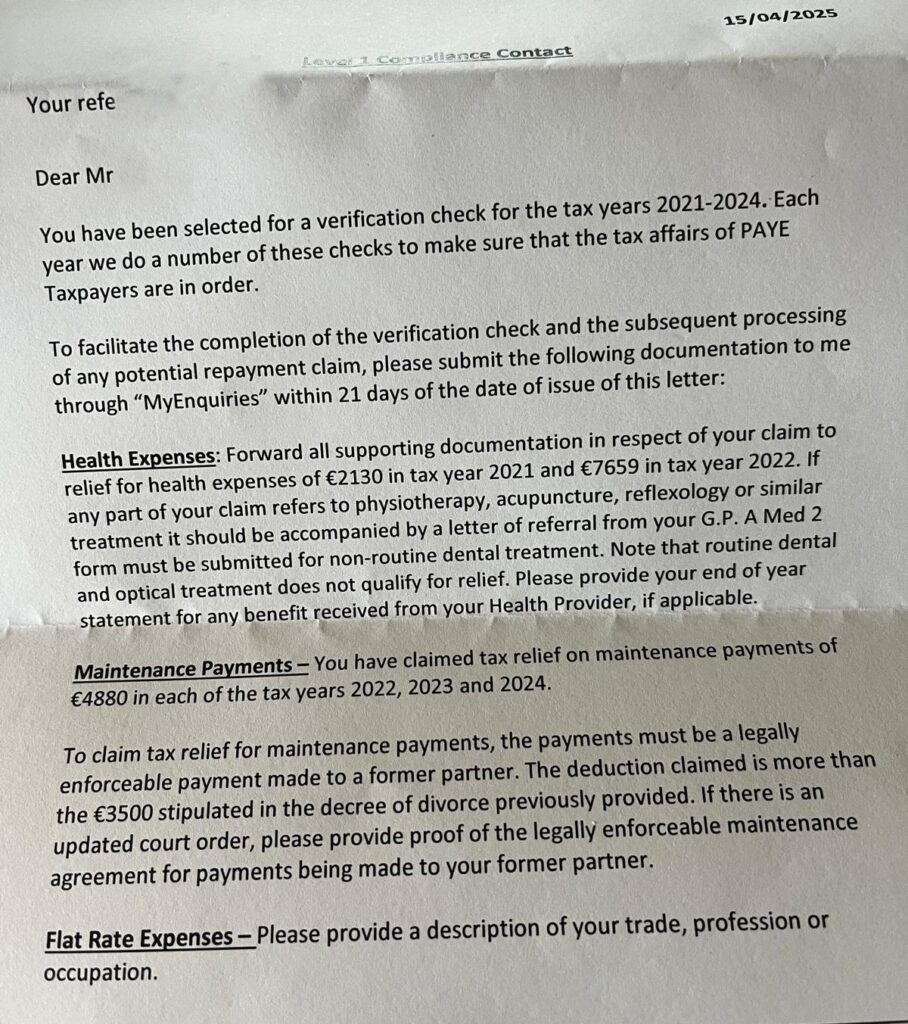

Are you serious about your business? Most people will say yes to this question. They have to be. There are bills to pay. Plus, you need a few bob for the annual trip abroad, not to mention the taxman taking his cut. It pays to be serious about your business. Here’s why. Rogue One Taxes

That nagging 'what if' about your finances? It's costing you growth.