Bookkeeping – Nail the foundations. Why should I do that? What’s in it for me? What even are the foundations? Sure, I’ll be grand. But will you?

This isn’t a lecture about you should do this and if you don’t then you are in big trouble. It is more to discuss what the basics are and how it benefits you to get this right. The bookkeeping basics are the foundations of your business. Strong foundations support a strong house. You nail them then you build a strong foundation for your business. Let’s have a look at

- Bookkeeping – what does it mean?

- A Good bookkeeper

- What are the foundations?

- Nail the foundations

- Summary

Bookkeeping – what does it mean?

Tax law has a section called “Obligation to keep certain records”. Every person must keep all records needed to ensure they can make a full and detailed tax return in respect of

- Income Tax

- Corporation Tax and

- Capital Gains Tax

Records include accounts, books of account, documents or other data. You can maintain the data “manually or by electronic, photographic or another process”. The books relate to

- Money spent and received in the carrying on of a trade or profession or other activity

- All sales and purchases of goods and services

- The assets and liabilities of the trade, profession or other activity

- The acquisition and disposal of assets for Capital Gains Tax purposes

Backup

The key point is that you have all the backup for the figures that are in your accounts. That is backup to support every number in your annual set of accounts. Your profit and loss account and balance sheet. It doesn’t only apply to trades and professions but all sources of income like

- Rental income

- Dividends and

- Interest

It also applies to claims in your tax returns like

- Interest deductions

- Cost of assets sold

- Claims like R&D Tax credit

- Medical expenses

- Pension payments

So, the more backup you have the more you support the numbers in your tax returns.

How long must I keep them?

You must keep them for 6 years. If your business or other activity ceases, then you must keep records for 5 years from the date of cessation.

The penalty for not keeping proper books and records is €3000.

A Good Bookkeeper

A good bookkeeper will get the numbers right and get your returns submitted on time. Plus, everything is up to date with payments. You have tax clearance, and you get your tax refunds when you should. This all helps with cash flow and limits your interaction with Revenue. What is everything?

- Payroll

- Vat

- Vat RTD

- RCT

- Bank reconciliations

- Expense claims

Some people love bookkeeping like Aedin in our office. She loves the stuff and takes great pride in getting everything right and balanced. Others hate it and I mean hate with a passion. A good bookkeeper has experience and is dealing with numbers day in day out. They know a client’s business and know if something is right or isn’t.

And if Revenue come calling, they have all the backup to answer the queries and have easy access to that backup.

What are the foundations?

The foundations for most businesses will be

- Vat

- Payroll

- Bank reconciliation

Vat returns

Most businesses will file Vat returns every two months. This is a summary of your sales and purchase invoices for the period in question. You pay Vat on your sales and claim Vat back on your purchases or business inputs. Then you pay what you owe to Revenue or secure a refund of what they owe you. A refund would be common in a 0% rated business like a food business.

So, for the Vat period Jan/Feb 2023 the return and payment must go to Revenue by the 23rd of March, at the latest. Failure to file on time or make the payment can result in a loss of tax clearance. Interest on overdue tax and even a referral to the Sheriff for collection. That is a complete pain as you can incur Sheriffs fees on top of what you already owe.

With Brexit Vat returns have become more challenging. The Annual Vat return of trading details can be a complex form to complete. The person doing your Vat return must know about

- Vat rates for different products and services

- Postponed accounting for Vat

- Intra EU acquisitions

- Margin Schemes

- Reverse charge

- Invoices, statements, quotes and PO’s etc

Payroll

As you well know keeping your employees’ happy benefits your business. They must get paid on time every time. And with a payslip that shows their correct payments and deduction. All sounds pretty straightforward, but it isn’t when you are dealing with

- BIK for cars or medical insurance

- Holidays

- Public holidays

- PRSI & USC classes and rates

- Understanding tax credits and rate bands

- Commencing and ceasing employees

Payroll is a mix of process, tax and HR. Calculations for public holidays can be tricky. Changes in laws during the year can impact the numbers like a recent change to BIK rates for motor cars and vans.

Getting this right is vital for any business. And if it’s not right then correcting it as soon as possible with good communication will limit the fallout. Minor changes in net take-home pay or incorrect figures can upset an employee and you will hear about it. Not getting a payslip is a complete non-runner.

Bank reconciliations

All your income and expenses will come from your business bank account. By completing a bank reconciliation, you can see all the income and expenses for a set period. Access to bank statements is important and they can be increasingly awkward to get.

If you rec your bank regularly during the year you can get a good overview of the business. You can see

- Your current cash position

- Lodgements for the period

- Expenses for the period

- Spot unusual withdrawals or creditors paid twice in error

- Compare to the previous months or to a corresponding period in the previous year

- See Revenue payments for Vat, PAYE, and other taxes going out or tax refunds coming in

A reduction in the bank balance will focus you to increase your sales or chase debtors. Keeping creditors paid on time will help with ensuring future supplies and securing discounts.

Nail the foundations

You will nail the foundations if your numbers are right, and you have a super process in place.

Getting the numbers right is ensuring you have the right person doing this job for you. That is someone with experience, training, and continuous learning. Someone could be very strong at Vat and doing bank recs but have no idea of payroll. In that case, you should outsource the payroll function.

If you don’t want to do this stuff yourself then you shouldn’t. A key tip here is not to give it to someone who is your friend or relative or friend of your third cousin. It’s too important. The numbers are your business. Don’t put someone in charge of them that doesn’t know what they are doing. There is a perception out there that anyone can do this. They can’t. We see the carnage that some clients create by doing it themselves or getting someone close to them to do it. It is dangerous and can ruin a business.

To ensure your numbers are right outsource the bookkeeping to your accountant. Do that if they have quality bookkeeping people that are experts in the areas you need.

Improve the process

How do I get a super process in place? Start with a process and keep improving it over time. Your process won’t be super from day 1. It will take time and the support of your bookkeeping team. Plus, your input too and your willingness to want to improve.

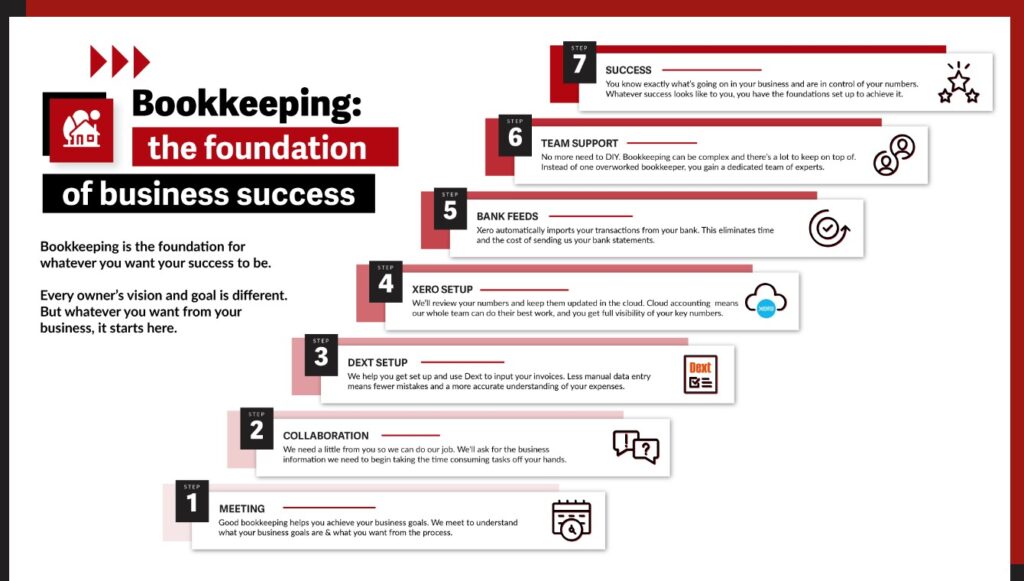

Think about moving away from paper and going digital. Why? Paper costs money. You have to buy it, print it, and store it and we are all moving to a more digital way of doing things. Cloud accounting is a strong consideration. We use Dext and Xero.

Dext to review and process your invoices. Plus, you can store your invoices here so there’s no need to keep hard copies. Purchases invoices can go in here straight from your supplier or you can scan them in from your phone. Especially handy for those small receipts for fuel, parking and others. Having all your invoices in one place on the cloud can give you ease of access as you have

- An archive of all your invoices for 6 years

- All invoices from each supplier

- All invoices per the highest number ie top 10 purchases invoices for a period

Xero

Once we review the invoices in Dext we push them into Xero. This is a cloud accounting software where you can see real benefits to know what your numbers are. There is huge functionality here. You can get so many reports on your sales, debtors, creditors, and costs. Plus, bank statements from AIB and BOI can now come into Xero once we link up the technologies. The beauty of this is that you can have up to date numbers during the year. This enables you to make business decisions based on live numbers. Clients of ours use the data in a variety of ways from

- reviewing their margins for a period and comparing them to prior periods

- analyse their wage costs as a percentage of sales and changing staff rosters as a result

- focusing on debtors and those who have gone outside their payment terms

- spotting overpayment to suppliers and securing refunds

- getting us to make payments and chase debtors

Moving forward

Some business owners only want to know that their numbers are right and that everything is filed on time. They can sleep well at night knowing that everything is ok. If Revenue come calling, there’s nothing to worry about.

Others want to analyse the numbers in greater detail to drive the business forward. Whatever approach the key is that the numbers are right. That is step 1 of nailing the foundations.

Summary

In summary

- Outsource your bookkeeping to your accountant if you don’t have the right person to do it

- Use a team that will have expertise across, Vat, payroll and accounts prep

- Reduce or eliminate paper by going digital

- Improve your process over time but invest that time with your bookkeeping team.

Remember investing in the numbers is an investment in your business. If this can help improve you to become more profitable there will be more money for you.

Want to nail your bookkeeping foundations? If so, Start here

Pingback: Bookkeeping - A Partnership Approach - Comerford Foley