Landlords Tax Changes in 2023 We will look at Landlords tax changes in 2023. While the focus of this is to look at changes, we will also look at some planning tips. The main areas to focus on are Pre-letting expenditure Retrofitting Rent tax credit Planning Tips The changes came in from the 1st

Tag Archives: Tax compliance

Our focus is to give you ten last-minute tax tips that could save you some money before the Income-tax deadline. The idea for this came from a tax meeting I had with a friend, Dash O’Donnell, who has a local business. Dash has a very good accountant but only found out about her large tax

We will look at some Revenue focus areas for 2023. The information for this came from a recent joint Revenue and Institute of Tax webinar. This is an opportunity for Revenue to get its message across. “Lads we are going to be looking at these areas, in particular, so don’t say we haven’t warned you”.

Letters, letters, and more letters. They are on the way. In this Autumn Tax update, we will let you know what’s coming down the line for businesses. The main points we will look at are Debt Warehousing – Self Review Debt Warehousing – End of Period 2 Local Property Tax Ulster and KBC bank accounts

Every quarter Revenue release a tax defaulters list. We will look at sectors that appear on the list and what the interest rates and penalties are. Plus tips to keep you off the list. The latest one was on the 14th of June last for the first 3 months of this year. Following on from

Revenue audits, tax collection and tax compliance are all things that can be a little scary to business owners. All these things could have you thinking: is Revenue watching me? I was on a tax course with Omnipro last week and Brendan from MK Brazil was the speaker. He was excellent as usual. One of

Every Friday evening I get a news update from the Institute of Tax. At times it has very little that is relevant to our clients and other times it has lots of great information. Last Friday was one of those times where it had plenty to offer. Here’s what we’ll be covering in this Mid-Year

Last week we looked at Xero from a beginner’s point of view. There are serious benefits. But you must be open to thinking outside the box when looking at your numbers. This week we are going to explore Income Tax returns and how a very super lady in our office gets them right first time.

Bookkeeping Is My Thing My sister is a nurse – our very own on-call 24-hour health adviser, whether she likes it or not! There’s a reassurance in knowing that she’s always at the end of the phone if there’s even a slight medical emergency. Her husband is self-employed and funnily enough she feels the same

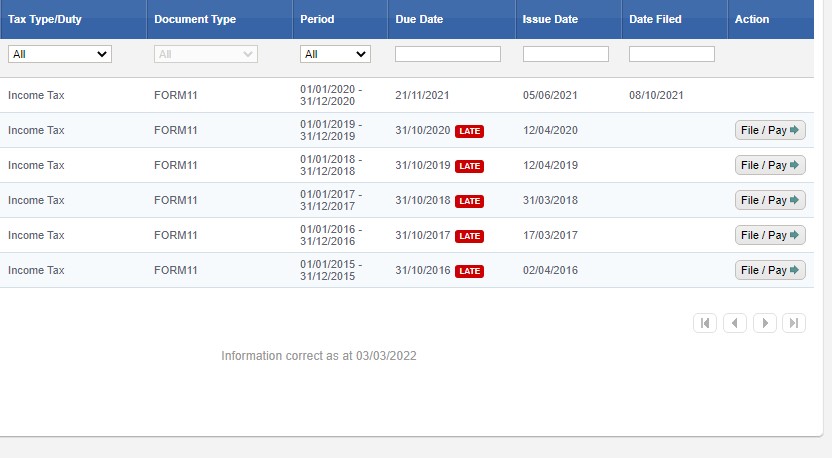

Last week we looked at development land. What it is, how you could use losses on that land against other gains, plus more. In case you missed it see here. This week our focus is on outstanding tax returns. We had two similar cases where clients that moved to us had late tax returns from