Let’s have a look at 5 Income Tax return Tips for 2022. We are now at peak Corporation Tax return filing time. On Monday the focus will switch to Income Tax returns for 2022. All with the view of keeping our clients tax compliant and Revenue happy. Revenue want the Tax return to know how

Author Archives: Colin Comerford

This week we’ll have a look at business exit planning. What are the things you should be discussing with your advisor? And what would you like to achieve? The main talking points will be Meet Maeve O’Leary How do I value my business Tax efficiency Future options Maeve O’Leary Maeve O’Leary, or Mol to her

Is your company shareholding right is the question that is tumbling around in my head. What sparked the idea for this blog was a meeting with a businesswoman on Wednesday. She wanted a chat about growing and valuing her business. Ultimately, she’d love to sell it and we got onto the topic of who owns

We’ll look at what’s involved tax-wise on the transfer of a site to a child. The idea for this came from a meeting I had with the Falcones during the week. John Falcone is the dad. Bridget Falcone is the mother and owns the land. Molly Falcone is the daughter. Points to cover will include

We’ll have a look at Company Taxes – The Basics, so please stick with me as it’s a hard sell. The best way to do this is by using an example to run through the basics. This will help you stay awake. Trust me on this one. Let’s delve into Introduction The Agenda The Meeting

Time of the year. More tax meetings with Company Directors than normal. Some are with clients and others are one-off consultations. A wide range of topics discussed. From electric cars to Income Protection, a lot of issues looked at. The question is always, what should I do? Let’s look at some of these to include

Be aware of your normal place of work when claiming expenses. Are you entitled to claim them and what are the things to watch out for? We’ll take a look at a case that came before the Tax Appeals Commission last year. Let’s find out more about The Stars The issues Case for Jerry Case

Let’s explore some Tax Tips for Farmers. Podge is a good friend of mine and a client too. Back in my hurling days, I used to mark him in training and he in turn marked me too. Still have the scars on my back. War wounds he calls them. Young Podge is in employment and

Non-resident landlords – Beds are Burning. There’s a new tax system in town and it’s gunning for you. It will take money from you and give it to Revenue. And it will be up to you to get it back. The lyrics of the Midnight Oil song Beds are Burning are washing around in my

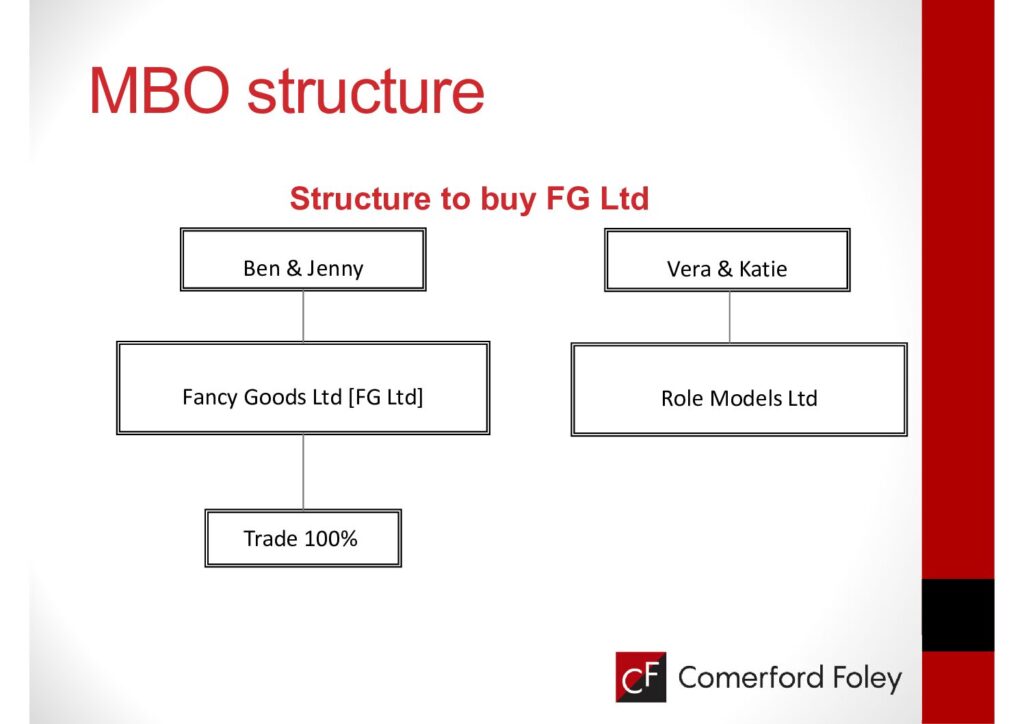

When you sell your business is a Management Buy Out an option? We look back at an MBO success story that we were privileged to be involved in. Ben and Jenny Fox own Fancy Goods Ltd which sells luxury products to wealthy individuals. They have a shop and a growing online presence. Vera and Katie