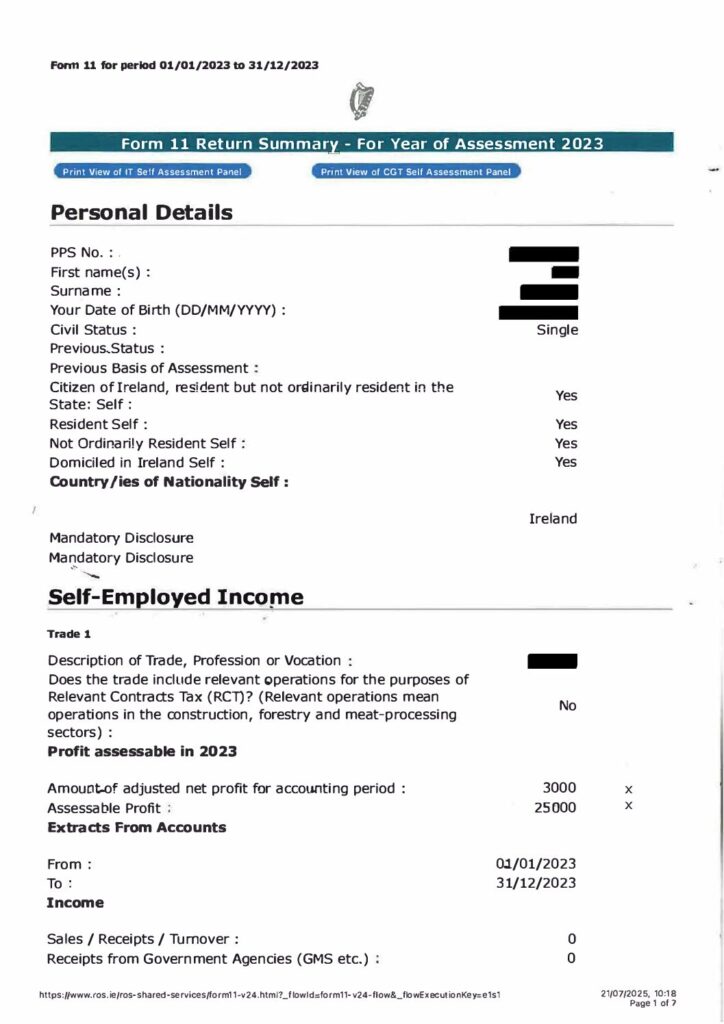

A tax refund for a non-resident is one of the first cases before the Tax Appeals Commission this year. It’s a short case at 10 pages. When the page numbers are low, it’s usually not a good outcome for the taxpayer. Then you read the first page, and you know there’s only one result here.

That nagging 'what if' about your finances? It's costing you growth.