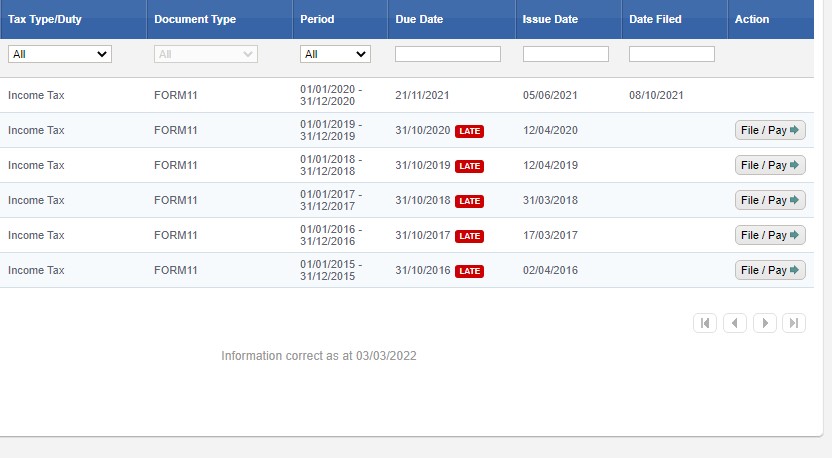

Last week we looked at development land. What it is, how you could use losses on that land against other gains, plus more. In case you missed it see here. This week our focus is on outstanding tax returns. We had two similar cases where clients that moved to us had late tax returns from

Category Archives: Tax Advice

Last week, apart from getting battered by storms, we wrote about our new website. In case you missed it see here. This week we are going to look at a query that came into us from a client that was going to sell some development land. We will look at What is development land? Our

In our blog last week, we met Sharon Stone and looked at the options she has to exit her business. In case you missed it you can read here. This week we are changing tack a bit and talking about marriage breakup – this blog explains the tax Implications of separation and highlights things to think

Last week we had a look at some options with vacant property in your company and whether to sell or change use. In case you missed it see here. This week we are going to look at the way we do things for our Income Tax clients. In 2022 we have decided to change the

Happy New Year from me and the cat or the Cat and I, which is better English. Timmy is very focused for 2022. He wants to be nicer to the other cats in the area, wants to eat better, and is planning to do 1k in March. But he is not doing dry January, to

This week we are going to look at some options for a business sale.Two weeks ago, we looked at Business Property Relief in action. This is relevant if you are making or receiving a gift or inheritance of business property. In case you missed it click here. It relates to a very interesting case that

Last week we did a whistle-stop tour of Tax return season. In case you missed it see here This week we will look at Business Property Relief [BPR] in action. It involved a very interesting last-minute case that crossed our desks in the middle of the month. We will look at The facts What info

Last week we looked at passing on a family company where there are excess investment assets. We introduced you to Mike and Brenda the owners of Cash Rich Ltd and their son Billy. In case you missed it see here This week we follow up on our blog from last week. We will look at

Last week we looked at why we do marketing. This is vital for any small business looking to grow. In case you missed it see here. This week we are going to look at a problem a client came to us with back in 2016. It was a very interesting case, and the final result

Last week we went through 5 tax tips when filing your Income Tax return. In case you missed it see here This week we will look at another 5 tax tips that are Flat rate expenses Home carer Credit Medical Expenses Pre-letting expenses and Tuition fees Flat rate expenses Certain employments get a flat rate