This week our focus is on the Employee Wage Subsidy Scheme [EWSS] and the 10 main things to know about this scheme. In our last blog we focused on tax tips to put more money in your pocket. In case you missed it See here What is the Employee Wage Subsidy Scheme (EWSS)? It is

Category Archives: Tax Advice

Hard luck to Waterford last weekend. What can you say? They came up against a team that was on fire on the day. Limerick were like a human wrecking ball that smashed everything before them. Their whole team was excellent and had 3 or 4 wonder performances on top of that. Huge credit to Waterford

I have to start this blog by wishing Waterford the very best on Sunday afternoon. It would be an amazing achievement to get over the line. It’s exciting to see all the flags around and the buzz it’s creating. Best of luck to the panel and the background team from all at Comerford Foley. The

It’s difficult for me to say this but well done to Waterford last Saturday evening in Croke Park. It was one of those games where Kilkenny would have been happy at half-time. Waterford supporters would have had a sense of “oh no here we go again”. Waterford hurled in the second half like their lives

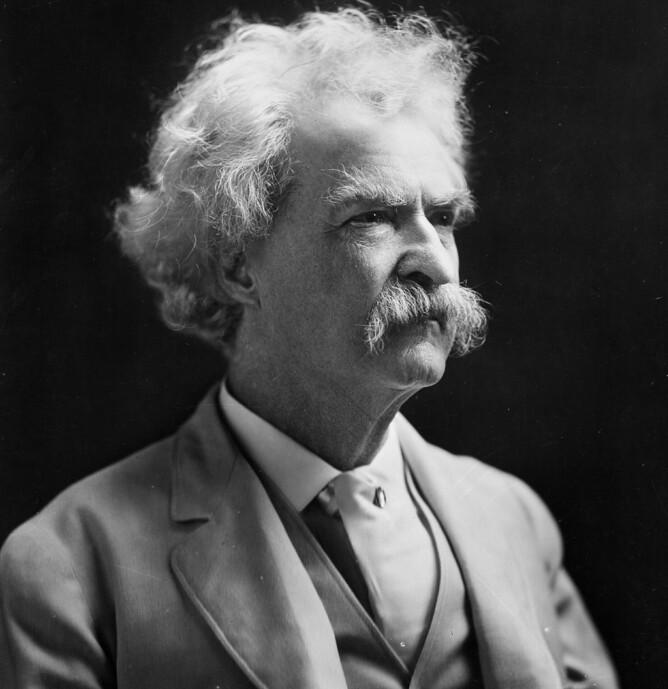

“The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin”. Mark Twain Last week we spoke about things you need to know when setting up a company. In case you missed it read here We are now into the thick of Tax return filing season. Corporation Tax [CT]

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.” Franklin D. Roosevelt Last week we looked at some of the tax implications of buying property in a company. We

Should you buy a property in your company? This is a question we get asked many times. My answer in most cases is NO. This week we will look at the reasons why it is not a good idea. We will look at the main tax implications of buying property in your company. The focus

As an employee, you’re not often thinking about what you can claim. When you earn the majority or all of your income from employment, your income tax and PRSI Contributions are taken automatically before you receive your pay. When you’re not in the habit of making a tax return, navigating the unfamiliar territory of claims

Are there tax advantages to be being married….? I probably could have finished that sentence with the words “apart from all the other advantages” Welcome back to the “You ask we answer” series of blogs that we do which are based on the questions that our clients ask us. I thought this might be a

Do I pay tax if I sell my family home? You ask we answer We are just over the Income Tax return deadline so are all able to take a collective breath and roll on to the next deadlines which are coming thick and fast. Thanks to the team in here it was a very