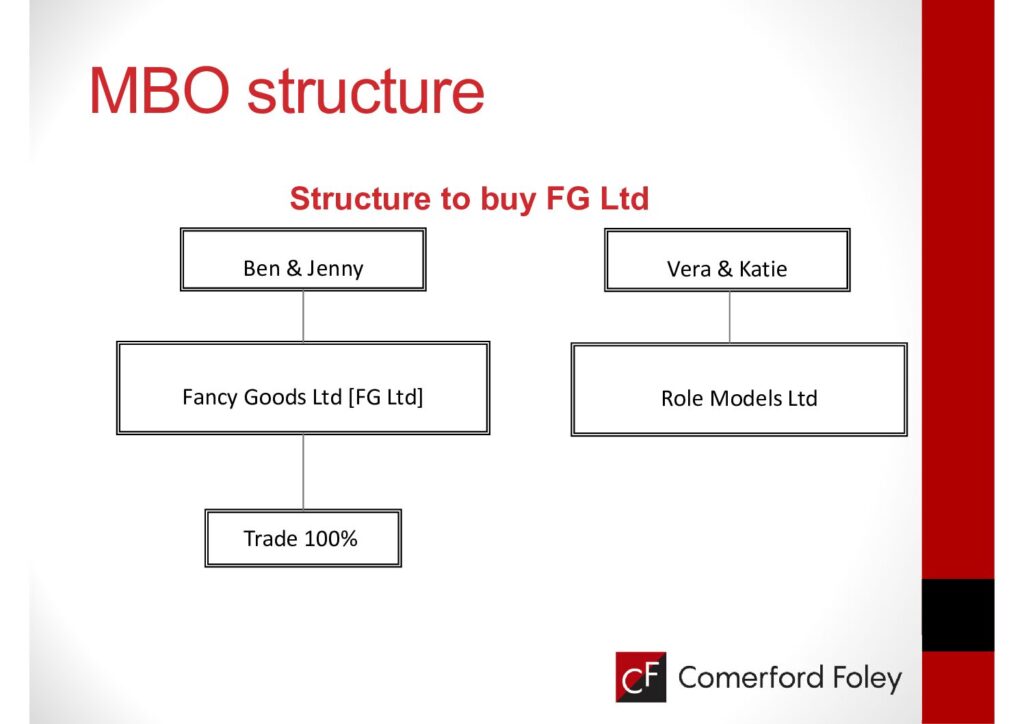

When you sell your business is a Management Buy Out an option? We look back at an MBO success story that we were privileged to be involved in. Ben and Jenny Fox own Fancy Goods Ltd which sells luxury products to wealthy individuals. They have a shop and a growing online presence. Vera and Katie

That nagging 'what if' about your finances? It's costing you growth.