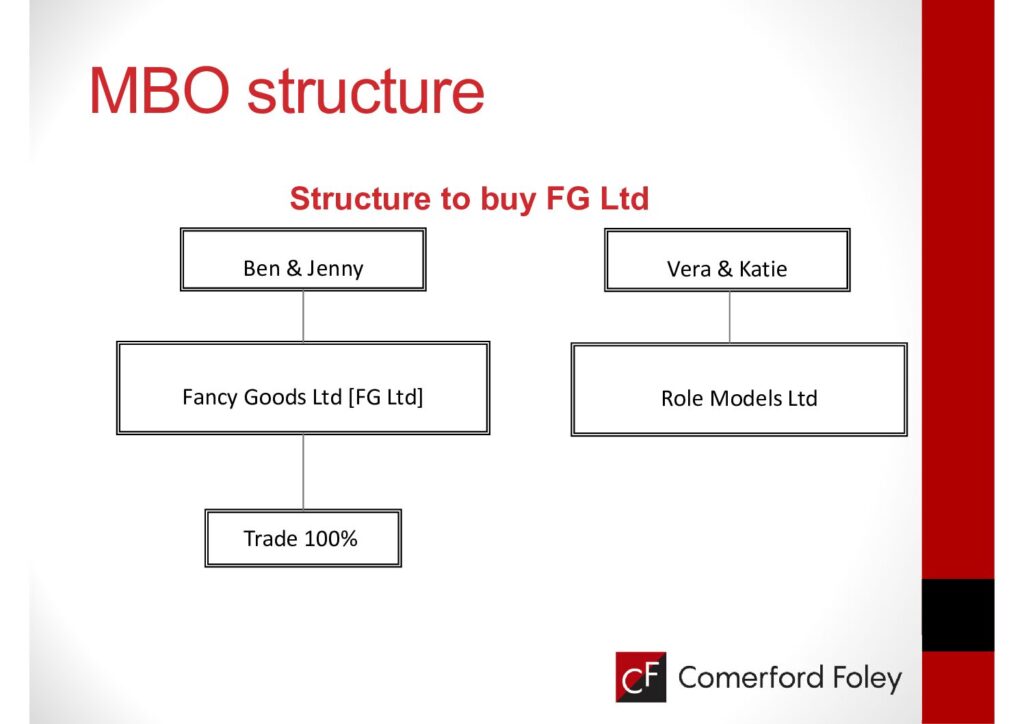

When you sell your business is a Management Buy Out an option? We look back at an MBO success story that we were privileged to be involved in. Ben and Jenny Fox own Fancy Goods Ltd which sells luxury products to wealthy individuals. They have a shop and a growing online presence. Vera and Katie

Category Archives: Company Director

My friend John calls me a bean counter, knowing that I am part of an accountancy and tax business. The bean counter reference is an accusation. A not-so-subtle dig at the accountancy profession. He doesn’t hold accountants in high esteem and is brutally honest about it. I came across the Bean Counter Cafe on my

Company Directors. Listen up. Tips to save Corporation Tax will be important to you in the coming months. The Corporation Tax [CT] deadline for companies with a 31 December 2022 year end is the 23rd of September. That is the last day to file your CT return and pay the balance owing for 2022. Let’s

It’s decision time for many company directors across the country. Should I take a bonus? We will look at a few examples of what I am talking about. One of which is how your business can help with personal wealth. The focus will be on Bar Coad Ltd and the options for Tommy. Talking points

We will look at Company Investments and Investment Bonds. We will introduce you to Don Gotti, the king of Dundalk. Companies will look to invest some of their excess cash. The purpose of this blog is to give you some information about a company investing in an investment bond. And comparing that to direct investing.

When selling your business, you want to maximise the value and pay the least amount of tax. But know you have covered all the bases. We will look at an asset sale and a share sale. Plus give you some Tax Tips that can help get things straight in your head. The focus will be

Is the Land Rover Discovery a car or van for BIK? This is relevant to other similar types vehicles taxed as “commercial” for Vat and VRT. You will get to meet Tom Dunne and Bill Flynn, directors of Bigbiceps Ltd [BBL], a supplement supplier. The main areas of focus are Car or Van – what’s

We will take a closer look at Retirement Relief and give you 5 Tips that can help you plan. “When I get older losing my hair Many years from now Will you still be sending me a Valentine Birthday greetings bottle of wine If I’d been out till quarter to three Would you lock the

We will discuss a recent case that involved Retirement Relief and farming. This case is not only relevant to farmers but to business owners too. It came up on my news feed last night and piqued my interest. How much tax was in play? What were the circumstances and who won? I got stuck into

Happy New Year to all our readers. We will look at the reasons why you should outsource your bookkeeping. The plan is to compare what your bookkeeping looks like now to what it could look like. Some people are not into the numbers. Our client once told us that he’d rather pick potatoes for a