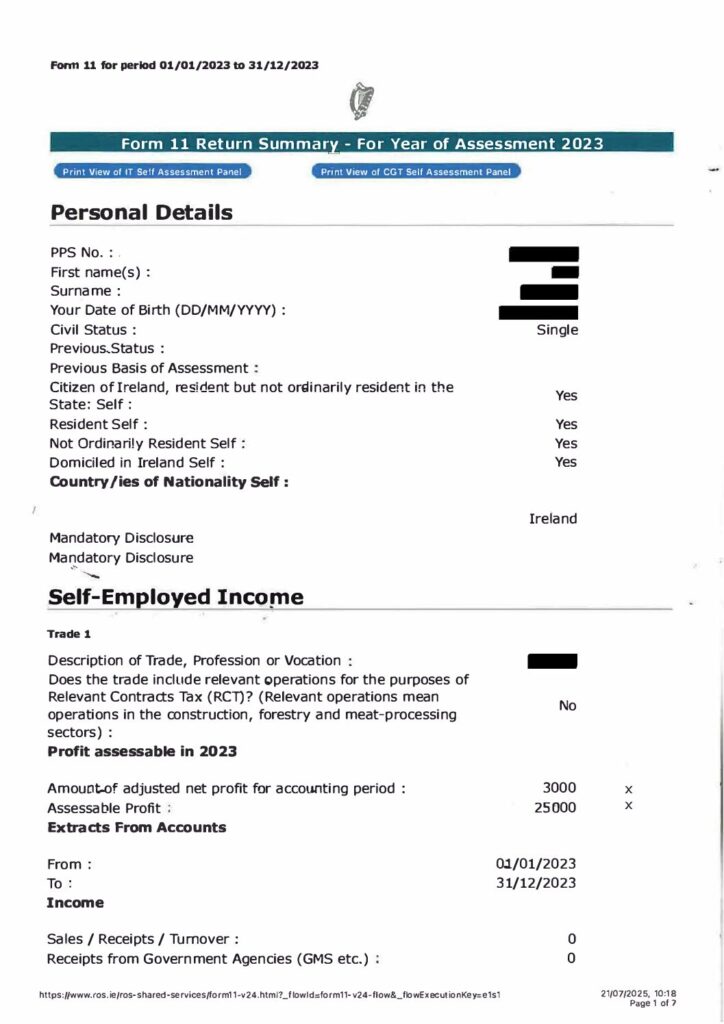

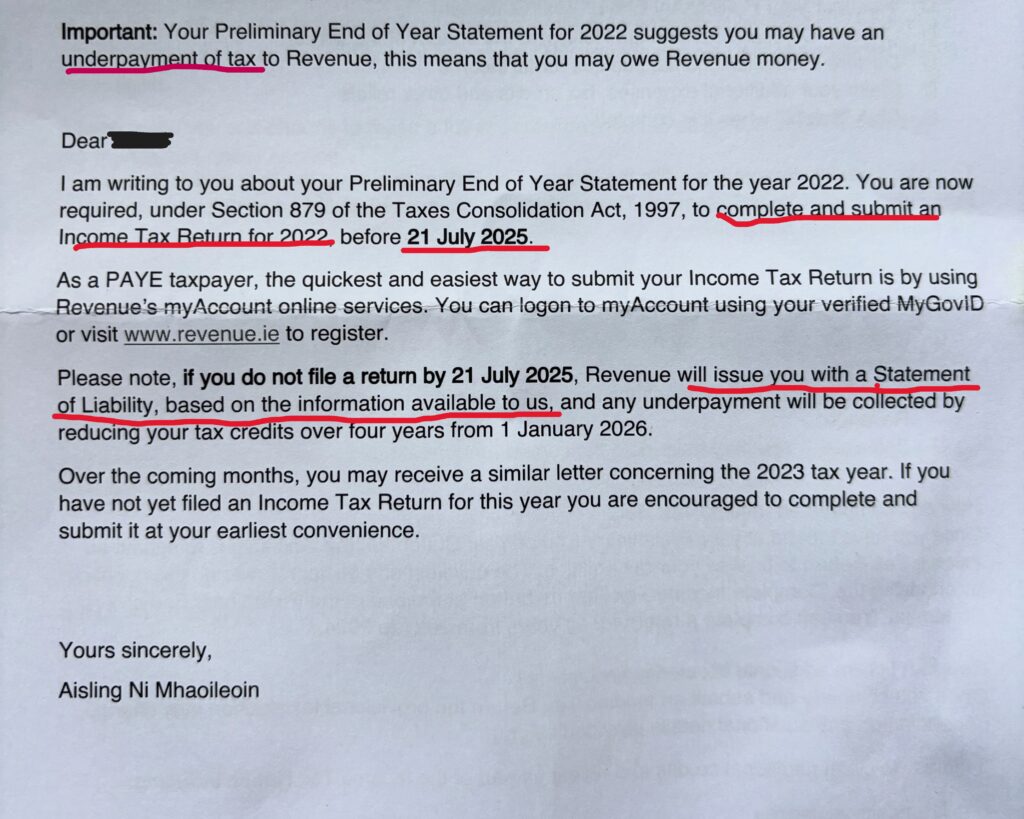

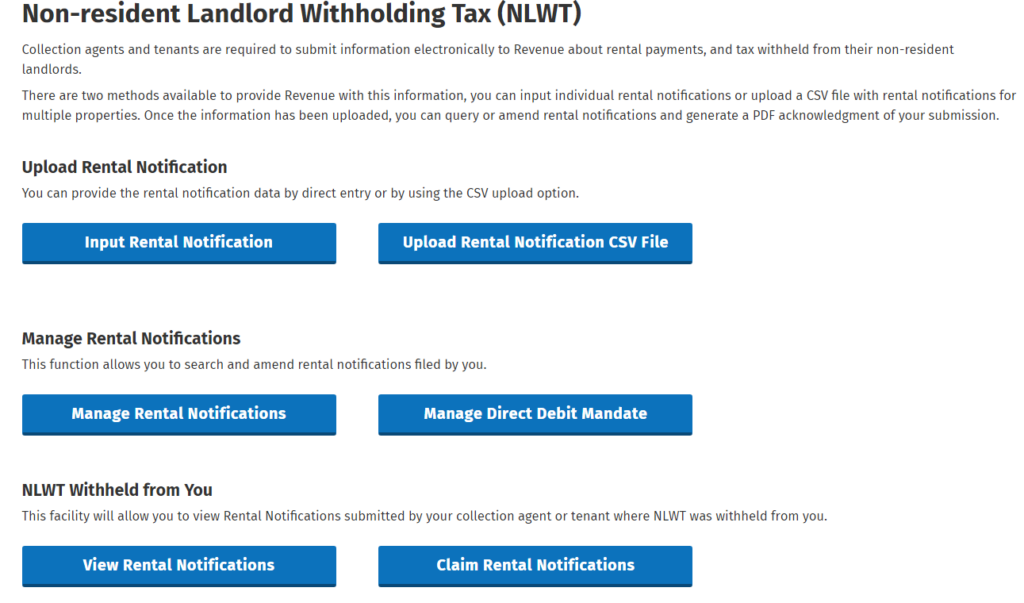

Word to the wise, T, don’t do your own tax return! Paulie “Walnuts” often used the “word to the wise” phrase when advising his mafia boss, Tony Soprano. It was to protect him so he wouldn’t end up “sleeping with the fishes.” The key message in this blog is that it can be dangerous to

That nagging 'what if' about your finances? It's costing you growth.