This week, I’ll look at a Revenue review of your Taxes. What prompted this is a Revenue letter that a former client got to review his taxes for four years, from 2021 to 2024. We did his tax returns for 2021 and 2022. He needed help to get set up right after a divorce in 2021. He completed his own returns in 2023 and 2024 as those were more straightforward. Let’s look at

- Background

- What Revenue want

- Level 1 Review

- Summary

Background

Randy Power is the man, or the client, I should say. Randy’s number popped up on the phone on Wednesday morning. I hadn’t heard from him in a few years, so something was up. The conversation went along the lines

“I got a letter from Revenue. They are doing an audit on me. I’m moving house at the moment and want to get this sorted. I spoke to a lady in there, and she told me it was a random audit. I might get you to deal with this. Sure, I may as well pay you the money as pay Revenue. They are not going to pay me the money they owe me until I sort this out.”

It was like the mother was dying, and he was calling the priest. I know Father, I haven’t been to mass in 20 years, but could you just pop over and read her the last rites! I asked Randy to send me the Revenue letter for a closer look.

Random and Audit

There were a few things that I noticed from the conversation, and the use of the words ‘random’ and ‘audit’. My view is that there’s no such thing as a random review anymore. Every review is very much targeted to specific circumstances. In Randy’s case, he was getting tax refunds for the four years. This was due to maintenance payments to his ex-wife and medical expenses.

It isn’t an audit in the sense of Revenue going through everything with a fine-tooth comb. They don’t use the word audit in their letter. But, in Randy’s eye’s it is an audit. Revenue want stuff from me because they are checking in on me. There’s a certain fear factor when getting these types of letters. It’s like an automatic feeling of guilt. The kind you get when you are stopped at a garda checkpoint. You haven’t done anything wrong, but think they’ll find something. Then you realise you forgot to tax the car!

Yet, they want specific information to verify that the tax refund Randy is getting is genuine. It’s Revenue’s job to protect the public purse. If you are getting money back from them, then your paperwork must be right.

What Revenue want

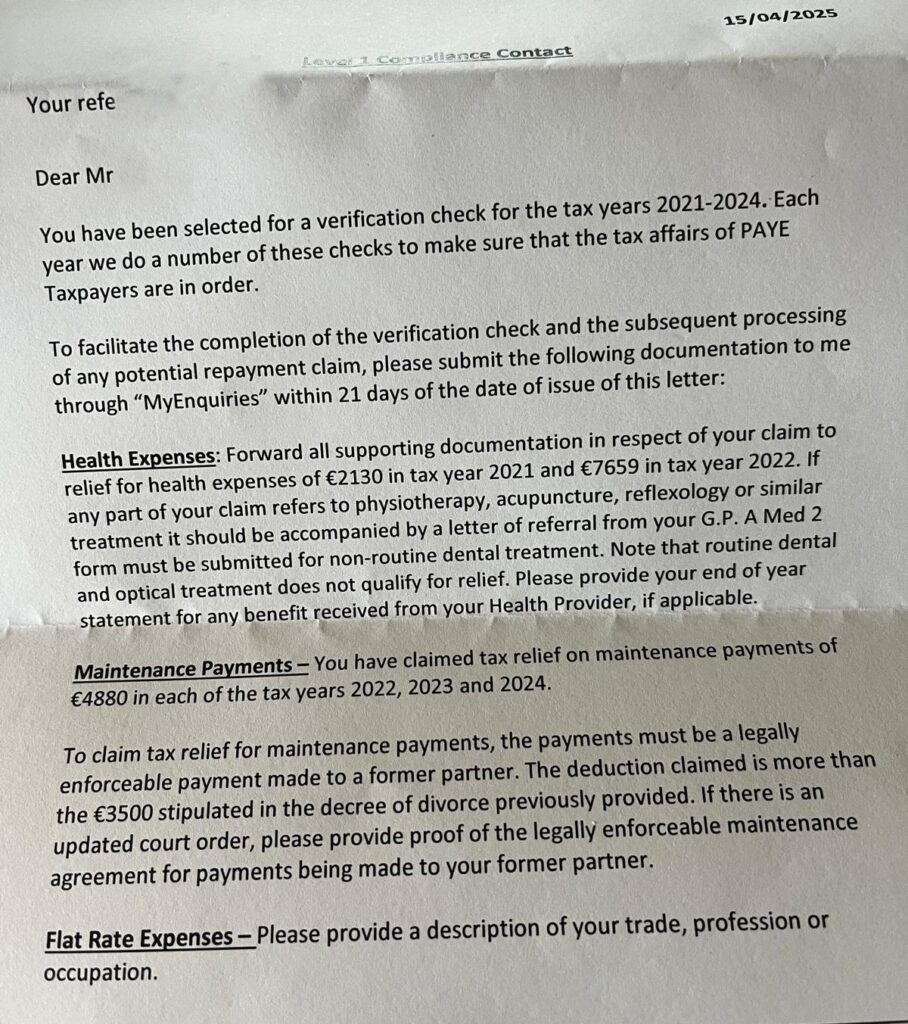

What Revenue want is very specific information. You’ll see from the letter that they want backup for medical expenses for 2021 and 2022. Looking at the numbers, Randy claimed health expenses of €2,130 in 2021 and €7,659 in 2022. A total of €9,789. Given that you get tax relief on health expenses at 20%, this is worth close to €2,000 to Randy. You’ll also see that if any of the medical expenses relate to

- Physiotherapy

- Acupuncture

- Reflexology or similar treatment

They want a letter of referral from his GP for this treatment. And if any of the expenses relate to non-routine dental treatment, they want a Med 2 form to support that.

Revenue has a query about Randy’s claim for maintenance payments. They have a copy of his divorce papers and know that there is a set amount of €3,500 confirmed in the agreement. But Randy has claimed €4,880 in each of the tax years 2022 to 2024. As the figures don’t tally, there must be an “updated court order”. So, if you have one, send that to us.

Revenue also want confirmation of Randy’s “trade, profession, or occupation. This is to verify if he’s entitled to a flat rate expense.

Next Step

The next step is to give Revenue what they are looking for. Whether we do that is up to Randy and us to decide. If we do the work for him then we will charge a fee for our service. Randy outsources his issue to us and we get it sorted asap. It’s to put Revenue in a position so they are comfortable paying the tax refunds to him. I would see this as a mix of

- phone calls,

- providing the right paperwork and

- explaining the maintenance claim difference

Revenue have given Randy 21 days to reply. If you get a similar letter and are under pressure to meet that deadline, then a courteous call to the caseworker involved can extend the timeframe.

Should Randy be worried?

No. Not for 2021 and 2022 anyway, as we submitted those returns and have all the backup. Plus, we can explain the different figures for the maintenance claim. Randy also agreed to pay medical insurance for his ex-wife, and her annual VHI premium came to €1,380 in each of the 3 years. This is in the divorce documents, and we will point out where Revenue can find it.

We have the backup for all his medical expenses, and there isn’t a claim that needs a Med 2 or GP referral letter.

If he wants us to look after the review for him, then we’ll check the 2023 and 2024 returns and backup to ensure they are ok. If not, we’ll confirm with Revenue any issues that arise.

Flat rate expenses [FRE]

He may not be entitled to flat-rate expenses for the four years. This is an odd one where Revenue gave flat rate expenses incorrectly to hundreds of thousands of PAYE workers. And we, as tax advisors, included those expenses on the tax returns of our clients. But, not so, for 2025 and onwards. Those of you who look at your Tax credit certificates [I know you are few and far between] will see there are no flat rate expenses on your 2025 cert.

The new system is not to give any, so you must claim them if your trade, profession, or occupation is on the list. The result of the new system is that thousands of PAYE workers are losing out. The note on page 1 of your 2025 Tax credit cert reads

“If you are entitled to FRE, please note that from 1 January 2025, you will have to claim this credit using PAYE Services

PAYE services is your myAccount.

Level 1 Review

You’ll see from the top of the letter (although faded) that this is a level 1 review. The letter’s heading is Level 1 Compliance Contact. There are three levels of Revenue reviews. Level 1 is the least serious, and Level 3 is the most serious. The Level 1 reviews are to remind taxpayers of their obligations. Plus, to provide opportunities for correction without extensive inquiries. Examples of the type of interventions in this category include

- Reminder notifications for outstanding returns

- Requests for self-reviews

- Profile interviews

- Engaging with businesses to ensure good compliance

A level 1 review can escalate to a level 2 or level 3 intervention. This can happen if something concerning comes to Revenue’s attention. Or the taxpayer fails to respond. The main disadvantage of going from Level 1 to Level 2 is losing the opportunity of an unprompted qualifying disclosure. On page 2 of the Revenue letter to Randy, it states

“This is a Level 1 Revenue Compliance Intervention. As such, it does not restrict your right to make an unprompted qualifying disclosure in this matter, if appropriate.”

In Randy’s case, there certainly would be no need to make a qualifying disclosure for 2021 and 2022. I’d imagine the same would apply for 2023 and 2024, but we’d have to check the return and backup first. While there will be some minor adjustments for flat-rate expenses, it wouldn’t warrant a disclosure. By minor, the adjustment would be less than €200 over 4 years.

The lowest level of penalty, 3%, applies to an unprompted qualifying disclosure and full cooperation. That penalty rises to 10% for a level 2 prompted qualifying disclosure.

Summary

When you get a Revenue letter to review your taxes, there’s no need to panic if your tax return is right. There’s value in good tax compliance and claiming everything you are entitled to. But claiming stuff you are not entitled to is fraud. Revenue are only doing their job here. If they are making transfers to your bank account, they are within their rights to ensure it is right to do so.

If you are in business, a quality bookkeeping function will look after the numbers. We all file tax returns, and what we put in them is up to us. By putting crap in them you are risking more interactions with Revenue. Is life not too short for that? We don’t want to spend our time dealing with Revenue. That’s why good tax compliance is so valuable. Less time dealing with Revenue means more time for you and your family.

Think of it. If you had the choice between the prom in Tramore, A Dooley’s in your left hand, and a 99 in your right hand, or holding for half an hour to talk to Mary in Revenue! What would you prefer?

Less stress leads to greater success.

Do you want a quality tax compliance service for your business and you? If so, start here