Word to the wise, T, don’t do your own tax return! Paulie “Walnuts” often used the “word to the wise” phrase when advising his mafia boss, Tony Soprano. It was to protect him so he wouldn’t end up “sleeping with the fishes.”

The key message in this blog is that it can be dangerous to do your own tax return. I have a “not to do” list. Included in that is ironing, tooth extraction, anything electrical, and car stuff. While this may paint me as a pretty useless human being, I know my limitations. Tax returns are long and complex. Getting them wrong can cost you. Nasty words like surcharges, interest, and Revenue interventions come to mind. Let’s look at

- Getting it wrong in 2023

- Rental Sector

- Capital Gains

- Summary

Getting it wrong in 2023

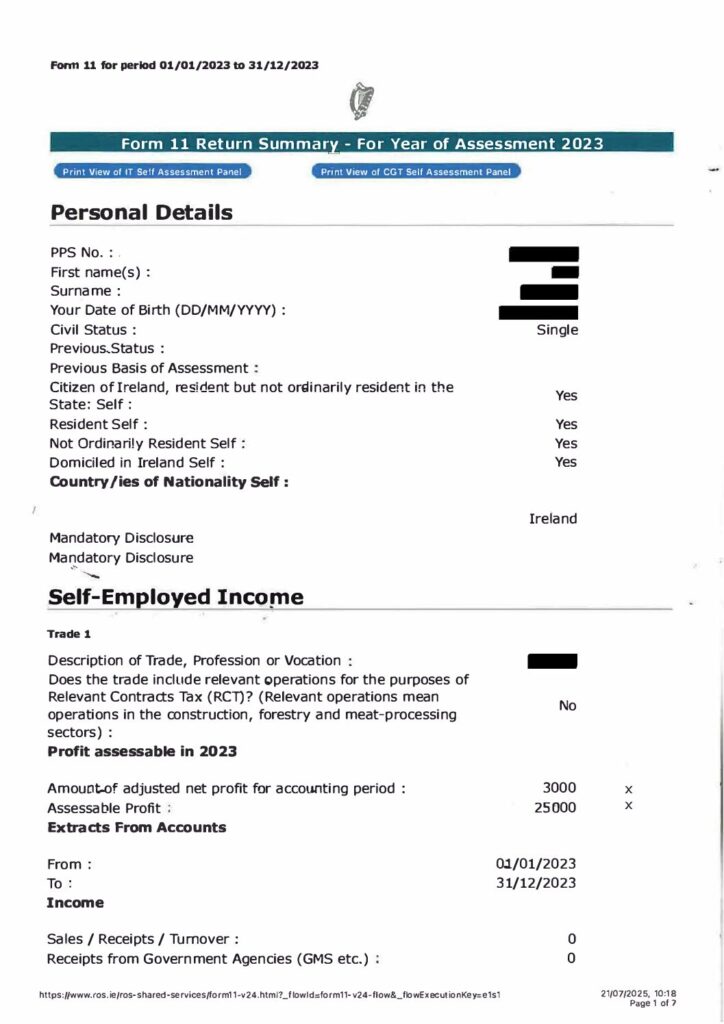

Mark Denver got it wrong in 2023. He filed his incorrect tax return late and was in surcharge territory. You’ll see page 1 of his tax return is the picture for this blog. Mike put these numbers in his return

| Income | €25,000 |

| Less Expenses Rent | (€7,000) |

| Motor & Travel | (€5,000) |

| Other expenses | (€10,000) |

| Trade Profit | €3,000 |

But he included the full €25,000 in the assessable profit box. The expenses he included weren’t right. In the end, he paid full tax on his income without deducting the correct legitimate expenses. He also didn’t claim a tax credit worth €1,775 to him. His tax liability, per the return he submitted, was as follows

| Profit | €25,000 |

| Tax on profit x 20% | €5,000 |

| Less Single Tax credit | (€1,775) |

| Net Tax liability | €3,225 |

| USC | €372 |

| PRSI | €1,000 |

| Total | €4,597 |

| Surcharge 10% | €460 |

| Total | €5,057 |

So, the problems here for Mike are twofold. Firstly, he filed an incorrect return, and secondly, his tax liability is too high.

Getting it right

Let’s assume that Mike engages his local tax consultant, Fred, to look after his 2023 tax return in May of 2024. They agree a fee of €900 to do the return and sundry computations. Fred reviews Mike’s bank statements and documentation. He calculates other deductible business expenses of €3,100. Mike will get a tax deduction for Fred’s fee too, so his profit for 2023 is €21,000. The tax liability on that is

| Tax on profit x 20% | €4,200 |

| Less Tax credits – Single | (€1,775) |

| Earned Income Credit | (€1,775) |

| Net Tax liability | €650 |

| USC | €240 |

| PRSI | €840 |

| Total | €1,730 |

The tax saving, when getting it right, is €3,327. Even after deducting Fred’s fee, the saving is still a handsome €2,427. Plus, Mike knows that his tax return for 2023 is right and isn’t worried about Revenue anymore. If Revenue has any queries about Mike’s 2023 tax return, they will ask Fred, his agent and tax consultant. A big win for Mike. No stress, no surcharge, and having everything right with Revenue, plus a lot more money in his pocket.

Rental Sector

I divide landlords in the rental sector into accidental and professional. The accidental landlord will typically rent one property, which is their former home. The professional ones will have two properties or more and run it like a business. With the housing crisis, the government’s policy has been to help landlords stay in the market. They have widened and introduced incentives and tax credits. All with varying degrees of complexity. The main ones are

- Pre-letting expenditure

- Retrofitting Expenditure and

- Residential Premises Rental Income Relief

- Non-resident landlords

Pre-letting expenditure

The normal rule is that you don’t get a tax write-off for expenses you incur before letting a property. There are some minor exceptions. But you can get a deduction for pre-letting expenditure on a property vacant for 6 months. The main rule is that the property is let as a residential premises for four years. This applies to expenditure incurred before the end of December 2027.

The general rule is that if an expense is allowable post letting, then it will also be allowable pre-letting. To qualify, you must incur the expenses in the 12-month period before you let the property. Allowable expenses are your normal expenses, like repairs, insurance, mortgage interest, and RTB fees. But you won’t get a deduction for enhancement works like new windows, doors, or a new kitchen.

We have found this relief to be very valuable to clients. The key is having good paperwork as backup for your costs. Given that you can claim up to €10,000, it can be worth up to €5,200 to a high-rate taxpayer. In some cases, when claiming the pre-letting costs, it can result in a rental loss in the tax year of claim. You can then carry forward that loss into the next tax year to reduce your rental profit.

Retrofitting Expenditure

You can get a tax deduction for retrofitting expenditure. But beware, this relief is due to end on the 31st of December 2025. There is a tax deduction of up to €10,000 per property for retrofitting works. A landlord can claim for up to two properties.

A condition to claim this expenditure is that the landlord must have received a grant from the SEAI for the retrofitting works.

One odd thing is that a landlord can only claim a deduction for this cost in their tax return of the next tax year. So, if you incurred these costs in 2023, 2024 is the first year of claim. You ignore any grant amount received.

Des Talbot incurred energy improvement costs of €19,500 in 2023, and his grant from the SEAI was €9,000. Des can claim a deduction for €10,000, being the max deduction, against his rental income in 2024. Like all these property relief now, you must be tax compliant to include LPT and be RTB compliant too. There are also clawback provisions.

Residential Premises Rental Income Relief [RPRIR]

This is a new landlord tax credit introduced in 2024 and lasting until 2027. I wrote about this earlier in the year, mainly giving out about it! Given that it’s worth €3,400 to a landlord over the four tax years 2024 to 2027, it’s a valuable relief. As the first year of claim is 2024, it has taken Revenue until now to get the credit right on Form 11 tax returns. It is still not right for some non-residents.

Like a lot of these reliefs, there is a carrot and stick approach from Revenue. To get it, you have to jump through hoops, most notably this year dealing with Revenue and all the time wasted with their incorrect calculations. There are clawbacks, and you’ll need to be aware of those.

Non-resident landlords

Most of our non-resident landlord clients have moved abroad to work for a few years, and they have let their homes here. New non-resident landlord tax rules came in in July 2023. A non-resident landlord must now make monthly rental notifications to Revenue. As part of this process, they also pay a 20% non-resident landlord withholding tax (NLWT) to Revenue. That is 20% of the gross monthly rent before deduction of expenses.

The non-resident landlords must have a collection agent in Ireland to look after this. This can be an accountancy business like ours or an estate agent who looks after the property for them. Typically, non-resident landlords will be in a tax refund position. They will pay tax on their net rental profit but have already handed over 20% of the gross rents. When you are abroad, you are getting to know a new tax system. You may not have the headspace to deal with Irish Revenue. You should also be entitled to claim the new RPRIR credit mentioned above.

Revenue have your money, and it’s up to you to file a correct tax return to get back what they owe you. Your rental profit can be a lot lower after deducting your allowable expenses. Especially when there’s a mortgage on your former home.

Capital Gains

Most people will be aware of the basic Capital Gains Tax [CGT] rules. The rate of 33% and the payment dates of the 15th of December and the 31st of January. Some think that once they pay the tax, that’s the end of it. A few will forget to file a CGT return, which is a form CG1. If you are in the self-assessment system, you file an Income Tax return Form 11 every year. As part of your Form 11, you can file your CGT return.

For those who forget or don’t bother to file a return, you will get caught with a 5% or 10% surcharge of the CGT liability. If there is no liability, there won’t be a surcharge. The complexity for taxpayers rests mainly in the calculation of their CGT liability. Often, taxpayers won’t know what deductible expenses to claim. They also may not know how to calculate available reliefs like PPR and property relief. Even these sections on the CGT return can be difficult to get right and result in unnecessary dealings with Revenue.

Tax on Tax and Interest

When reading the Institute’s weekly tax fax, the latest Revenue e-brief caught my eye. The “Guidance on surcharge for the late submission of returns.” It confirms that the surcharge is part of the tax liability, and you pay interest on the tax liability, including the surcharge.

Say you sell a house in the summer of 2023, and the CGT liability is €50,000. You should have paid the tax on the 15th of December 2023 and filed your CGT return by the 31st of October 2024. It is January 2025, and you decide to sort this out. There is a 10% surcharge on top of the liability, as you were more than two months late filing the return. And you get caught for the interest on the tax, including the surcharge.

| CGT liability | €50,000 |

| Surcharge for late filing 10% | €5,000 |

| Total CGT liability | €55,000 |

| Interest on €55,000 from 15 December 2023 to Jan 2025 [0.00219% per day] | €5,120 |

| Total | €60,120 |

So, tax on tax and interest on top. Like sprinkles on top of your 99!

Summary

The above are some examples of where tax returns can go wrong and can get more complex. Mark knew he had to do a tax return, panicked, and threw any old crap into Revenue that cost him a lot more than it should. Plus, his tax return is wrong, and Revenue will come back to him on this if he doesn’t fix it before they come calling.

Rental Income is always on the Revenue Radar and is a “hot topic” every year across their various divisions. They have the information from many sources. They know if you are not returning the rent or under-declaring and will eventually catch up with you.

CGT can be tricky, mainly with the calculations. You don’t want to miss out on valuable reliefs and losses, plus completing the sections of the return isn’t always straightforward. We haven’t even mentioned other areas like Offshore funds, which are increasingly complex. Plus, you don’t want FOMO when it comes to the tax credits you can claim, with thousands of taxpayers missing out on credits they are entitled to.

In my 30 years working with client taxes no one has ever said to me that they love dealing with Revenue. People shudder and break out into cold sweats at the mention of Revenue. So, reduce the stress, get things right and don’t do your own tax return.

Need help getting your taxes sorted with Revenue? If so, start here