In this Tax roundup, I will talk about a few things I have seen over the last few weeks. A few tips that can save you money or even stop you panicking in a tight situation. There’ll even be a paragraph where I go all “Victor Meldrew” about Revenue. I’m trying to stay calm, as I’m just back from holidays, but they are testing me. Let’s look at

- Unexpected Tax Bill

- Single Person Child Carer Credit

- Glanbia Shares & Stamp Duty

- RPRIR Again

- Summary

Unexpected Tax Bill

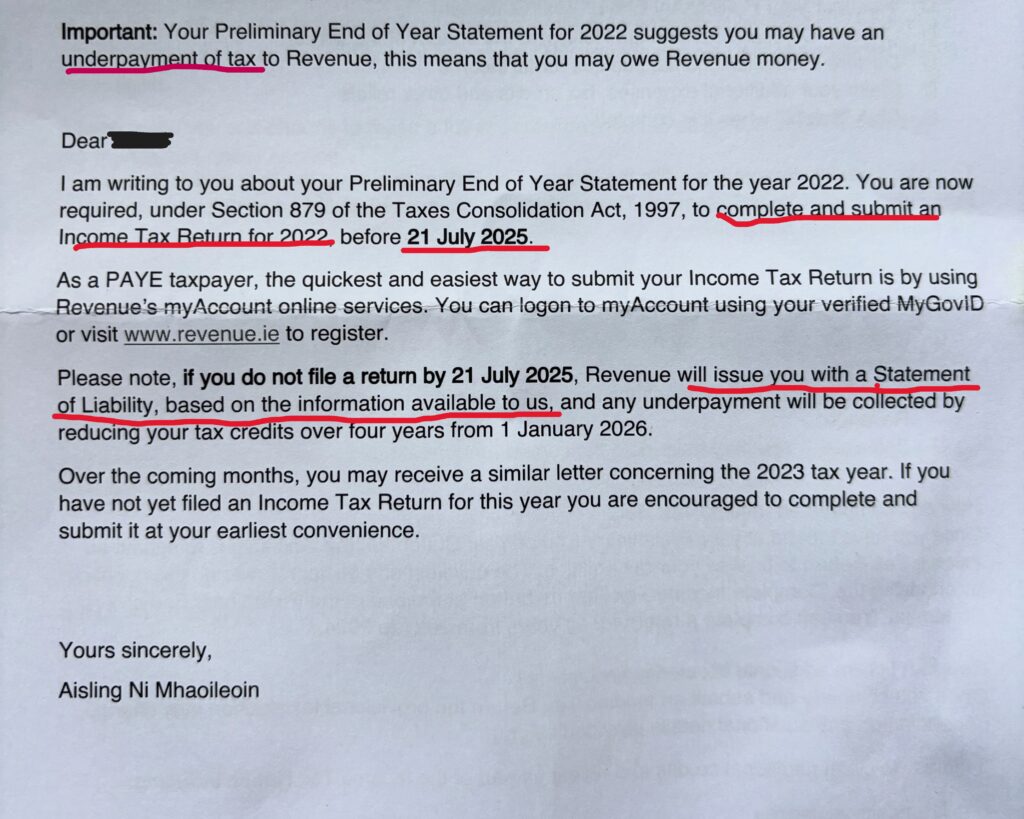

Our client’s ex-wife, Mary, gets a letter from Revenue landing her with an unexpected tax bill. Based on our numbers, you owe us €3,819 for 2022. As a result, we want you to file your tax return by the 21st of July. If you don’t, we will issue a Statement of Liability based on the information we have. And they will collect the €3,819 by reducing her credits over four years from the start of 2026.

Mary is a teacher who has recently started her summer holidays. Not the best start, and she’s in a panic about it. She contacts us for help. We get access to her MyAccount to see how the tax liability arises and to review her 2022 tax credit cert.

The Numbers

We can see that she had a lower rate band of €45,800 as a married person. She also had the married tax credit of €3,400 and a PAYE credit of €1,700. Mary and her husband separated in 2021, so she was single in 2022. I would like to point out that Revenue didn’t do anything wrong here. They would have known about the separation after the 2022 tax credit cert was issued.

Given that Mary was separated, she wasn’t entitled to the extra €9,000 at the lower rate or the married credit. Plus, there was €1,595 of illness benefit.

| €9,000 x 20% | €1,800 |

| Extra married credit | €1,700 |

| Illness benefit €1,595 x 20% | €319 |

| Total | €3,819 |

The Plan

The plan is to file the tax return but reduce the liability as much as we can. We can do that by claiming

- The Single Person Child Carer Credit– SPCCC

- Employee Expenses

- Medical expenses

By claiming the above, we can reduce the liability to €1,075. A saving of €2,744.

| SPCC | €1,650 |

| Extra rate band €4,000 x 20% | €800 |

| Flat rate expenses – teacher €518 x 40% | €208 |

| Medical expenses €435 x 20% | €87 |

| Total | €2,744 |

While there will be a much smaller liability owing of €1,075, she can let Revenue collect that over four years. My view would be to pay it to get rid of it, so she isn’t paying on the drip from 2026 to 2029.

Single Person Child Carer Credit [SPCCC]

The SPCCC came up on a couple of occasions lately. Once during the week when I met a client, Liz. Liz’s daughter Phoebe did a Masters in UCC in 2023 and finished in August of 2024. Liz is widowed, and we claim the SPCCC for her every year. But this year, the question arose about the type of Masters that Phoebe was doing. In 2024, the SPCC is worth €2,550 to Liz.

Was it a taught Masters or a research Masters? The reason for the question comes back to the rules to get the credit. One of the rules is that a “qualifying child” is resident with the person claiming the credit. That must be for the whole or greater part of the year of assessment. A “qualifying child” who is over 18 at the start of the tax year must be

- receiving full-time instruction at any university, college, school, or other educational establishment.

Full-time instruction

Per the Revenue guidance notes, full-time instruction includes

- All courses relating to primary degrees and diplomas in all public and private colleges

- Programmes of training for any trade or profession (apprenticeships) where the training period is not less than 2 year

The notes go on to state that

“Full-time instruction does not include post-graduate and doctorate programmes where the student is primarily involved in self-managed research and learning, which do not involve the prvision of full-time instruction”

So, as Phoebe was doing a taught Masters, and getting full-time instruction, Liz will get the SPCC for 2024. Even though the Masters finished in August 2024, she will get the full credit and increased lower rate band for the year. She won’t get it for 2025.

“If a child in receipt of full-time instruction ceases in school or college, the credit will continue to be granted for the remainder of that year but will not be due in subsequent years”

Glanbia Shares & Stamp Duty

Liz also sold Glanbia shares in 2024. She got these shares from different spin-offs from Glanbia Co-op [Tirlán]. Her 2023 Tirlán interest statements looks like this

| No of Shares | Current Interest | Arrears of Stamp Duty | Net Payable |

| 30,000 | €5,780 | €1,330 | €4,450 |

You will see that the stamp duty was €1,330 which is 1% of the value of the shares that Liz got in September 2022. Liz, being a very shrewd lady, asked me two questions

- Did she pay tax on the net or the gross interest? and

- What about the stamp duty? Does she get some tax break for that?

The first question had me squirming in my seat a bit. My answer was “let’s look back and see what we did for 2023.” As I opened up our Income Tax calculation, I was hoping for the best!

Liz paid tax on the gross interest of €5780. This is correct. As for the stamp duty, that is a cost of acquisition of the shares. When she sells those shares, she will get a deduction for the stamp duty paid. Liz sold those Glanbia shares in 2024, and we claimed a deduction for all the Stamp Duty paid.

RPRIR Again

Yes, RPRIR again. The landlord’s tax credit has been nothing but a pain in the you know where from the start of 2025. It’s worth no more than €600 for 2024. One assessment I got from Revenue had given a client Tom €1800 of RPRIR, which was

| Tom | €600 |

| Wife | €600 |

| RPRIP Corrected amount | €600 |

Worst of all, Revenue told me this was right now, and the client owed €1200 less than their correct liability. “I don’t believe it,” I said to myself, going all Victor Meldrew. I submitted this client’s tax return on the 1st of April. Perhaps that was an omen. A self-assessment letter issued on the 7th of April, agreeing with my figures. Our calculation in column B of the self-assessment panel didn’t agree with the Revenue calculation in column A. The reason was that their calculation had the incorrect RPRIR amount for a married couple. Ours had the correct €600 figure.

Five Notices of Assessment later and numerous My Enquiries messages, there is now only €38 at play. But it is €38 that our client is owed. That should get it sorted with the sixth Notice of Assessment! The issue is with a married couple who own a share in a rental property that qualifies for RPRIR. Revenue made a balls of the calculation, and it has taken them 6 months to fix it.

I have been over and back with the Institute on this. And there we were, thinking we were doing a great job getting clients’ tax returns done early! It has been a huge waste of time and resources dealing with Revenue on this for a few clients. Poor Tom, the client in question, picked up a hand injury from opening up all the post he’s getting from Revenue.

Summary

Anyway, I better stop giving out for fear of putting you all in a bad mood coming into the weekend. The RPRIR lesson is that this is the sort of stuff we look after for clients. Clients don’t have to deal with Revenue on these technical and time-consuming issues. Our duty to our clients is to get their taxes right and to have minimal interaction with Revenue.

From our Tax roundup, we are there to help Mary out with a worrying issue for her. Liz got her SPCC and a reduced CGT bill with the stamp duty reduction. Even poor Tom will get the correct amount of RPRIR, eventually.

Getting your taxes right protects you and gives you confidence. You know that if Revenue come calling, you have nothing to worry about, and we are there for you to answer any queries. But getting it right the first time is the way to go. The helps keep Revenue away from you as much as possible. They torment us instead!

Do you need a helping hand to get your taxes right? If so, start here