When you sell your business is a Management Buy Out an option? We look back at an MBO success story that we were privileged to be involved in.

Ben and Jenny Fox own Fancy Goods Ltd which sells luxury products to wealthy individuals. They have a shop and a growing online presence. Vera and Katie are two managers in the business. Vera is brilliant at sales and Katie manages the team and keeps a good eye on the numbers.

Ben is like Tracy Chapman. He has a fast car and is trying to find a plan to get “us” out of here. Jenny, like Jenny from the block, used to have a little but now has a lot. But she knows where she came from!

We’ll look at how Ben & Jenny can sell the business to Vera and Katie. And a structure that works for the Management Buy Out. We’ll focus on

- Background

- First Steps

- The Deal

- Taxes

- Lessons Learned

Background

Back in 2019, Ben was 67 years old and Jenny was 66. He and his wife Jenny ran Fancy Goods Ltd for over 20 years. They own the company 50:50 and have worked hard over the years to grow the business.

Ben and Jenny have grown a strong team and two senior managers, Vera and Katie, have been vital to that growth. Ben and Jenny own the shop. They approach Vera and Katie to see if they’d have any interest in buying the business from them. Both understand Vera and Katie wouldn’t have the funds to buy it. Despite this, they see them as vital to the continued growth of the business.

That initial meeting is very positive. Vera and Katie are very interested but the big fear for them is how they can afford to buy it and what is a fair price. This is very unfamiliar territory for them, but they trust Ben and Jenny. The Foxes call out to meet us to discuss the initial steps.

First Steps

The first step that Ger points out is to value the business. What would a fair price be for the business and how would you value it? Ben knows that this must be fair for both sides and achievable too.

Our first task is to do a valuation and once that is ready to go through the numbers with all parties.

Ger gathers all the information and numbers to complete a business valuation. The figure he arrives at is €1,500,000 which he calculated using the numbers below

| Future maintainable profits | €312,500 |

| Multiple | 4 |

| Business value | €1,250,000 |

| Cash balance | €250,000 |

| Total Value | €1,500,000 |

All parties meet to go through the numbers. Vera and Katie are in shock which has them questioning if a deal would be possible for them. After all, they don’t have this kind of money and they wouldn’t know where to start to look for it either. We reassure them that there are options but first, they need to be comfortable with the number.

With this in mind, they decide to get the help of another accountant to go through the numbers.

The Deal

To get the deal over the line Ben’s view is that Vera and Katie must be happy the number is fair. After all, they will be working hard in the years ahead to pay for it while Ben and Jenny will be in retirement bliss.

The elephant in the room for Vera and Katie is affordability. Is this all just pie in the sky? Sure, how can they come up with the money to pay for it? Ben & Jenny know this is a major issue so have tasked us with coming up with a plan.

The deal we come up with is an initial lump sum upfront payment of 50% and the balance over 4 years. The balance is payable on reaching set financial targets.

| Upfront payment | November 2019 | €750,000 |

| Based on 2019 accounts | June 2020 | €187,500 |

| 2020 accounts | June 2021 | €187,500 |

| 2021 accounts | June 2022 | €187,500 |

| 2022 accounts | June 2023 | €187,500 |

After various meetings Vera and Katie are happy that the value of the business is fair. They’d be confident of meeting future payments as there’s €300,000 in cash in the company now. And business looks strong for the immediate future. Their big concern is the initial payment and how do they structure the deal.

Structure

Both have €50,000 that they can put into the pot to make the initial payment. They talk with a couple of banks and one bank agrees to loan €650,000 to fund the initial payment. A major win for Vera and Katie.

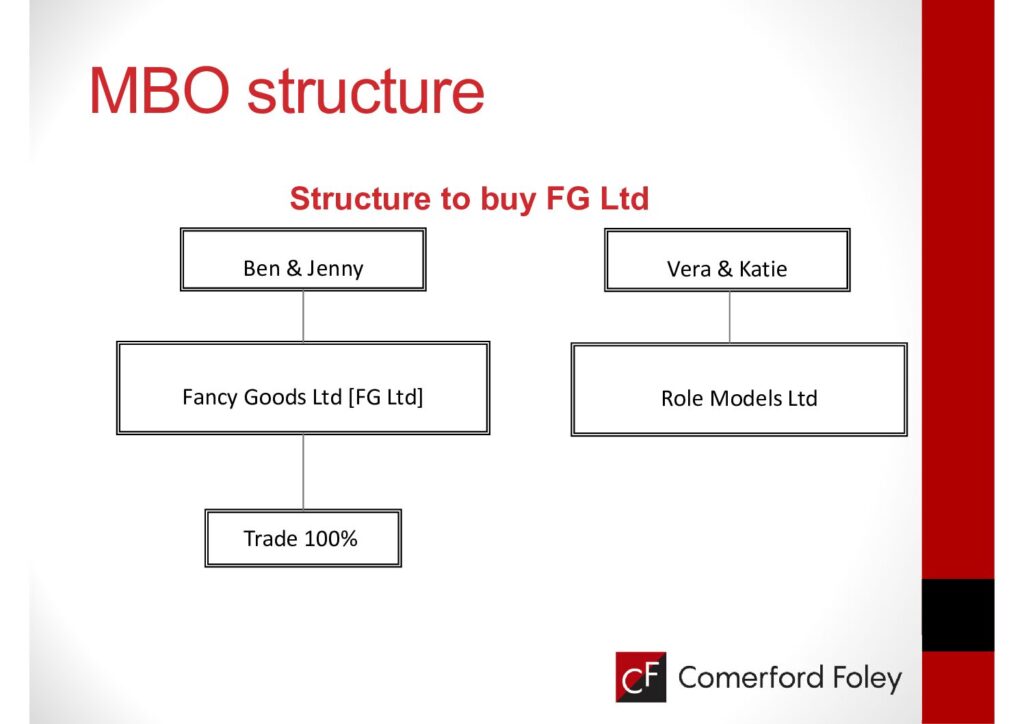

We come up with the structure, considering Revenue guidance and legislation. As in what you can and can’t do. The plan is to set up a new company to buy the shares. They will own this 50:50. Dee sets up the new company called Role Models Ltd. Once the company is set up, they sort out a bank account and introduce €100,000 into it. Their bank loans €650,000 to Role Models Ltd [RM Ltd] to fund that initial payment.

In a nutshell, RM Ltd will buy 100% of Ben & Jenny’s shares in Fancy Good Ltd for €1,500,000. RM Ltd will pay 50% upfront and the balance over 4 years. RM Ltd owns 100% of the shares from the outset but Ben & Jenny only get €750,000 in 2019.

Not wanting to put you asleep with the words “tax legislation” but it is important you know the traps here. What Revenue don’t want to see is the use of existing funds to buy the business. Paying a dividend of €300,000 from FG LTD to RM Ltd to fund the purchase wouldn’t work. In that case, Revenue would treat the €300,000 payment to Ben & Jenny as a distribution liable to Income Tax.

There is no issue with refinancing post the purchase, per Revenue guidance. To repay the bank loan of €650,000 RM Ltd could get a loan or dividend from FG Ltd and use those funds to repay the bank.

Taxes

Even though the Foxes only get €750,000 in 2019 they will pay Capital Gains Tax [CGT] on the full sales proceeds of €1,500,000. They dispose of 100% of their shares in FG Ltd. As the full price is certain Revenue expect to get their share straight away.

There are some CGT reliefs available to reduce the blow. Retirement Relief [RR] and Entrepreneurs Relief [ER] are both relevant. We crunch the numbers to see what works best.

As both are over 65 the most Retirement Relief they can get is €500,000 on a sale to a third party.

| Sales Proceeds Ben | €750,000 |

| Legal & accountancy costs 50% | €25,000 |

| Net Proceeds | €725,000 |

| Retirement Relief threshold | €500,000 |

| Excess over threshold | €225,000 |

| Marginal relief – 50% of excess | €112,500 |

The figures are the same for Jenny, so both would pay €112,500 or €225,000 in total with RR.

With Entrepreneurs Relief they pay tax at 10% on the first €1 million of gains. Given that both meet the conditions of ER they qualify for €1 million each.

| Sales proceeds Ben | €750,000 |

| Legal and accountancy 50% | €25,000 |

| Net Gain | €725,000 |

| Tax at 10% | €72,500 |

Again, the numbers are the same for Jenny. They opt for ER and will pay CGT of €145,000. As they sign the deal before the end of November 2019 the CGT payment is due by the 15th of December 2019.

Future Payments

Given that both have paid tax upfront on the full sales proceeds there will be no tax to pay on the future payments. Likewise, if they don’t get all future payments then the sales proceeds are less and they would be due a refund of CGT.

In the years 2020 to 2022 FG Ltd continued to trade successfully with very hard work from Vera & Katie. FG Ltd exceeded all the targets agreed under the earn-out arrangement. Resulting from this success, FG Ltd was able to loan money to RM Ltd to make the agreed payments to Ben & Jenny. They received the full €750,000 from RM Ltd over the years 2020 to 2023 as per the share purchase agreement.

From a Revenue point of view, these payments were out of the profits in the accounts of 2019 to 2022. They weren’t payments made from the retained profits in the business before the sale.

Lessons Learned

From our point of view, it is brilliant to be part of a successful story like this. Ben is only delighted with his fast car, roof down, and hair blowing in the wind. Glory days from Bruce Springsteen on the stereo. Enjoying life with Jenny and sure who knows they might even renew their wedding vows at some stage. The honeymoon on a Hawaiian island at the White Lotus hotel.

It’s worth mentioning that this wasn’t all plain sailing from the beginning. There is negotiation and doubt and even harsh words at times that can upset people. But there was always trust and honesty there and, with that, a willingness to thrash out a deal. All sides had buy in and the importance of good legal and accounting advice is vital too. [Of course, he’d say that I hear you cry!] Both sides had to get a fair deal and an achievable outcome.

For Vera and Katie, they now own 50% each of a successful business and have a huge incentive to drive it on. They have blossomed as business owners and who knows about the future. In ten years they could look to sell and cash out and they will be well-versed if another MBO is on the cards.

Want to know more about your options when exiting your business? If so, Start Here