We will look at a holding company structure and see how this works. You’ll get to know the O’Driscolls and their reasons for setting up a holding company. The main points that we will look at are

- Introduction

- How it works

- Advantages

- Disadvantages

- Summary

Introduction

Ron and Conor O’Driscoll [Rod & Cod] are brothers, in their 40s, and run a very successful clothing company. Their brand “Couch & Tea” caters to the plus-sized market and is very profitable. The company has cash reserves of €2.5 million and the brothers would like to invest some of that cash.

Rod & Cod have worked hard growing and expanding the brand over the last 10 years. In an ideal world, they’d love to sell the company in the next five years if the price is right. An investment opportunity has come their way that has piqued their interest.

Ron was on holiday in the Algarve last Summer. He’s not one to sunbathe for two weeks so he took a spin around the local town on the Algarve. A gorgeous villa with a stunning view and private swimming pool caught his eye. Taking the bull by the horns he met the selling agent, Carmen Maura Silva Dos Santos Mourinho. Carmen for short! She gave him the lowdown about the area, the price and some other investors who purchased.

It was like when Ron met Mary [2nd wife] first, he fell in love all over again. But this time it was bricks and mortar that had him in a flutter. On his return from Portugal, he floated the idea of buying the villa with Conor. The company had the cash to buy it, but they didn’t. Wanting to see how the company could do this they booked a meeting with us.

How it works

In that initial meeting you could sense the excitement of the O’Driscoll brothers. There was huge potential for this as an investment. Rental income from the property would be about €100k per annum. Plus, they felt there was a strong likelihood of capital appreciation.

Separate company

Owning a Portuguese property in their trading company wasn’t an ideal situation because

- As a non-trading asset, it could impact CGT reliefs if they sold the company in future

- A likely buyer for the trading company may not want to buy a Portuguese property.

- They wanted to keep the trading company as simple as possible to make it easy for a purchaser to buy their shares

- In the event of a severe downturn in trade they wanted to keep investment assets out of the hands of creditors

They decided that the investment had to be in a separate company.

Holding Company

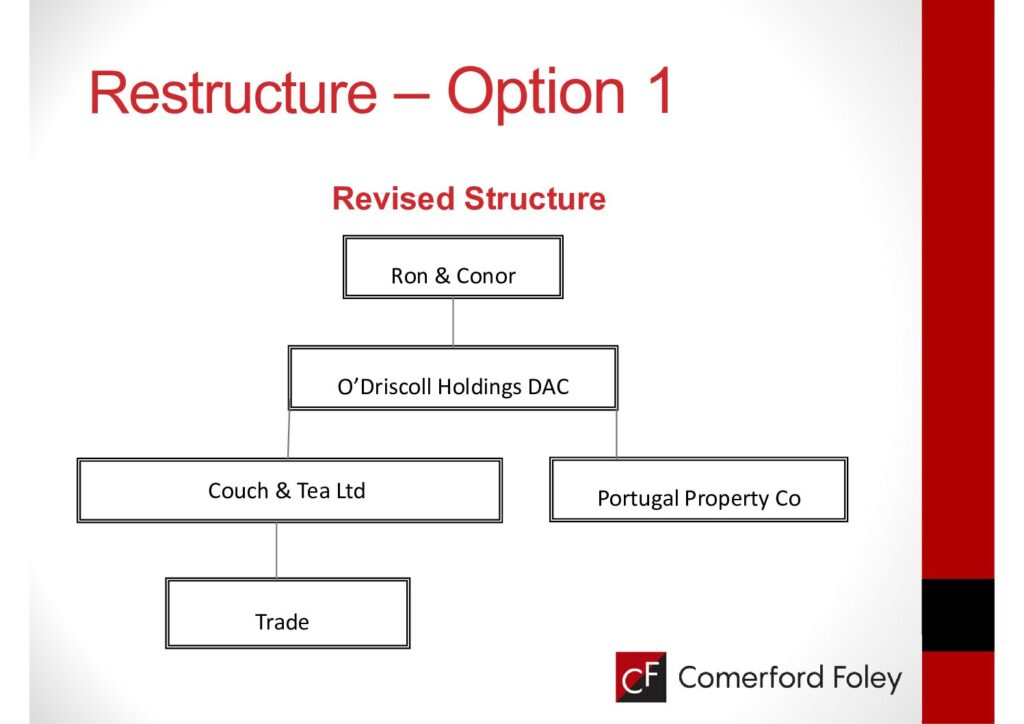

One of the options we discussed was a holding company [holdco] structure and how that would look for them.

The idea would be to set up a Holdco [O’Driscoll Holdings] that would sit above the trading company. The money would go from “Couch & Tea” to the Holdco. It would then use that money to buy shares in the Portuguese company that owns the villa. A group structure.

The group would be three companies.

- ODH [holdco] at the top

- Couch & Tea [tradeco] underneath and

- Portugalco being an investment company underneath

Steps to set up

- O’Driscoll Holding DAC is set up and owned 100% by Ron & Conor – 50% each

- Put Holdco structure in place. Ron and Conor swap the shares they own in Couch & Tea Ltd for new shares in ODH

- Option to keep a 10% shareholding in personal names

- ODH gets funds, by way of a dividend, from C&T to fund the purchase of the Portuguese property

- Portuguese property company is under the ownership of ODH and is not part of C&T

Advantages

In our meeting Conor asks the question. What if someone comes along and offers us €10 million for C&T? Where does the money go and what taxes do we pay?

If ODH owns 100% of C&T, then the €10 million goes to ODH. Provided the Holdco structure is in place for 12 months there would be no Capital Gains Tax to pay. Yes, no CGT!

But if we assume the O’Driscolls keep 10% of the shareholding in C&T then €1 million goes to them [€500,000 each]. €9 million goes to ODH and again there is no CGT once in place for 12 months. The tax advantage of the structure is a saving of close to €3 million [€9 million x 33%]

One of the main reasons to hold onto 5% is to benefit from Entrepreneurs Relief [ER]. One of the key conditions for that relief is that you must own 5% of the shares. Assuming both qualify for this relief the CGT for each would be at 10% and not 33%

| Sales Proceeds – Conor | €500,000 |

| Tax liability 33% | €165,000 |

| Net Proceeds | €335,000 |

| Tax liability 10% | €50,000 |

| Net Proceeds | €450,000 |

| Tax saving with ER | €115,000 |

Dividends

We already mentioned that ODH can take a dividend from C&T and use that to fund the purchase of the property company.

There is no dividend withholding tax [DWT] on a dividend from one Irish company to another. But you still must file the correct DWT form with Revenue. This is a big advantage as the DWT rate is 25% here and that rate would apply to any dividends to the shareholders. As a result, there are no taxes on moving funds from C&T to ODH.

Stamp Duty savings

Ron and Conor are disposing of their shares in C&T Ltd to ODH. On a share transfer, there is Stamp Duty, and the rate is 1% of the market value. Based on a current market value C&T is worth €5 million. So, a stamp duty cost of €50,000 if they transfer 100% of their shares or €45,000 on a 90% transfer.

On a corporate restructure or amalgamation there is a stamp duty relief once the

- Acquiring company acquires at least 90% of the shares in the transferring company and

- The scheme of reconstruction or amalgamation is for bona fide commercial purposes

If the O’Driscolls decided to hold onto 20% of the shares in C&T and transfer 80% to ODF then the relief wouldn’t apply. The purchaser [ODH] would be liable for the Stamp Duty of €40,000 within 44 days of the transaction.

Disadvantage

The main disadvantage, of a trade sale, is that the money stays within the corporate structure. The money is in the company and not in the bank accounts of Ron & Conor. If they want to take money out, they can do that by salary or dividend.

Or, if in a position to do so, they could liquidate the holding company. In that case, a payment by the liquidator is a payment for their shares. That is a capital payment and would be liable to CGT at 33% and not Income Tax at 52%.

But is having €9 million that you own in a company such a disadvantage? It very much sounds like first-world problems! This is cash in your company and can give you so many opportunities as it can be

- A pension fund for you. Take out dividends every year to top up your income

- An investment vehicle to invest in other companies or investment assets

- A very valuable asset to transfer to the next generation.

Summary

The main reason why the holding company structure works for the O’Driscolls is that it keeps C&T clean. They don’t want any potential sale scuppered with a Portuguese property in Couch & Tea. Plus, it gives them a set structure to keep investment and trading assets separate. And we can’t overlook the huge CGT saving on a potential sale down the line. If the Portuguese property investment goes well, it could be the first of many.

Do you need help setting up a Holdco structure for your company? If so, Start here