Don’t miss out on the Home Carer Credit. Based on what I have seen over the last few weeks, thousands aren’t getting this credit. In 2025, it’s worth €1,950. I have seen three cases recently where people should be getting this, but they aren’t aware of it. Let’s explore a bit more about it to see if you can get this credit.

- Do you qualify?

- The rates

- Recent meetings

- Summary

Do you qualify?

To qualify, you must be jointly assessed for Income Tax. To be jointly assessed, you will be married or in a civil partnership. You also have to care for a dependent person who is

- A child for whom you get the children’s allowance

- A person who is over 65 or

- A person who is permanently incapacitated due to a mental or physical disability

Dependent Person

If you care for a dependent person who is a relative of yours or your spouse, that person doesn’t have to live in your home. They must live

- Next door in a neighbouring home

- On the same property or

- Within 2 kilometres of your home.

The most common way a couple get this is where one spouse is working and the other is at home minding the kids. Say Pat and Mary are married and have two young twin boys John & Edward. Pat is working and is on a salary of €100,000. Mary is at home full-time looking after the lads.

Lower rate bands

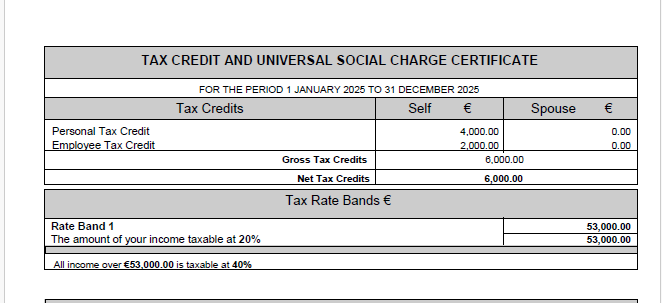

For 2025, the lower rate band for a single person is €44,000. For a married couple, the max lower rate is €88,000. But the most one of the spouses can earn at the lower rate is €53,000. Pat’s tax liability, ignoring PRSI & USC for 2025, would be

| First €53,000 x 20% | €10,600 |

| Balance €47,000 x 40% | €18,800 |

| Total | €29,400 |

| Less Tax Credits | |

| Married | €4,000 |

| PAYE | €2,000 |

| Home carer | €1,950 |

| Tax liability | €21,450 |

If Mary was working too, the most she could earn at the lower rate in 2025 is €35,000. Combined, she and Pat would have €88,000 at the lower rate.

Dual Income Couples

Dual-income couples can’t claim both the increased standard rate band and the home carer credit. It is one or the other, and Revenue will determine which is the most favourable for you. Let’s assume Mary is gone half cracked at home, looking after Jedward, and she gets a part-time job. Her earnings in 2025 are €5,000. In the first computation below, we use the increased standard rate band

| First €53,000 x 20% | €10,600 |

| Mary’s €5,000 x 20% | €1,000 |

| Balance €47,000 x 40% | €18,800 |

| Total | €30,400 |

| Less Tax Credits | |

| Married | €4,000 |

| PAYE – Pat | €2,000 |

| PAYE – Mary | €1,000 |

| Tax liability | €23,400 |

In the computation below, we use the home carer credit

| First €53,000 x 20% | €10,600 |

| Balance €52,000 x 40% | €20,800 |

| Total | €31,400 |

| Less Tax Credits | |

| Married | €4,000 |

| PAYE – Pat | €2,000 |

| PAYE – Mary | €1,000 |

| Home Carer | €1,950 |

| Tax liability | €22,450 |

You’ll see that Pat & Mary are better off by €950 when claiming the home carer credit in 2025.

Rates

The home carer credit rates for the last few years are

| 2025 | €1,950 |

| 2024 | €1,800 |

| 2023 | €1,700 |

| 2022 | €1,600 |

| 2021 | €1,600 |

The reason for giving you the rates is that if you didn’t get the credit, but were entitled to it, it’s not too late. You can go back four years from 2021 to 2024. That would be worth up to €6,700 for you. To claim the credit for 2025, you can do this on myAccount by

- Click the ‘Manage your tax for the current year’ link under ‘PAYE Services’.

- Select ‘Add new credits’.

- Click ‘Home Carer Tax Credit’ in the ‘You and Your family’ section.

- Fill in your dependent’s details, including their PPSN and date of birth.

- Complete the process and submit.

Tax Meetings

I had two meetings recently with prospect clients who had come back from abroad. In both cases, the husbands were working, and the wives were at home looking after the kids. The more difficult job! I went onto their myAccounts to see their 2025 tax credits. Neither of them had the home carer credit on their tax credit certificates for this year. For one, I applied for it there and then, and the other guy said he’d look after it himself.

It could be a common miss among ex-pats coming home. They have been out of the Irish tax system for a long time, so they aren’t as familiar with tax credits and the Irish tax system. Revenue can also up their game when issuing the tax credit certificates every year. They are very closely linked to the Department of Social Protection. As a result, they should know when a married couple is getting children’s allowance. Once the couple is jointly assessed, and one spouse/civil partner has no income, then give the credit.

Tax reviews

I was doing a tax review on an old/new client. Someone who left us a few years ago but came back for 2024. As part of the review process, we have a copy of their 2023 tax return that they or their accountant submitted. The wife, we’ll call her Bridget, is self-employed. Her profit for 2023 was low at €1,500. This was covered by capital allowances and losses forward. They were jointly assessed and have kids under 18, so they would be getting the children’s allowance for them. The problem is that they never ticked the home carer credit on the tax return. So, they missed out on €1,700 for that year.

Plus, they missed out on a medical insurance credit of €200. The husband’s employer pays for his medical insurance. They are down €1,900, but we’ll get that back for them. Given that this happened in 2023, we will review 2022 and 2021 too, to see if they claimed the credit or not. Looking at their Revenue record on ROS, my gut feeling is they will be due refunds for those years too. They already got small refunds for both years, which could be for medical expenses. We’ll go exploring to see what we can find out!

As I am writing this, I am looking at the tax credit cert of another former client who came back to us a few months ago. The home carer credit isn’t on his tax credit certificates for 2023, 2024, and 2025, but it should be. His wife isn’t working, and they have kids under 18. More digging to see if he got this in his tax returns for the last few years!

Summary

The home carer credit is a valuable tax credit. With close to €400 million in unclaimed taxes every year, per Revenue, people are missing out. Where only one spouse is working, and you are looking after kids or a relative, then you should have it. If one spouse is earning a small amount of income, then it’s a choice of the best option. Either the home carer credit or the increased lower rate band.

This is money that should be in your pocket but isn’t. Don’t have FOMO and get your taxes right.

Do you need to get your taxes sorted? If so, start here